|

As we stand subjected to yet another 0.50% rate increase from the Bank of Canada today (https://www.bankofcanada.ca/2022/10/fad-press-release-2022-10-26/), for many of us, the weight on our chests is growing. Although the 0.50% increase is slightly less than some experts were predicting, it still hurts just the same. It’s a difficult time for everyone, to say the least, especially for homeowners who have adjustable or variable mortgages, or for anyone with a mortgage who is getting nervous about their upcoming mortgage renewal.

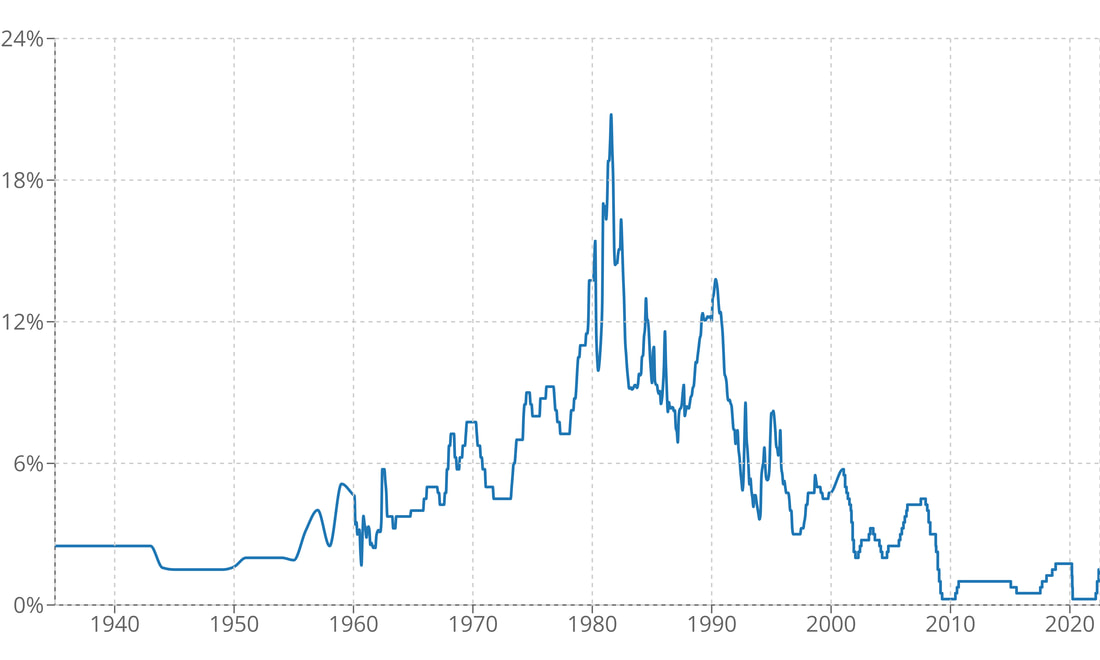

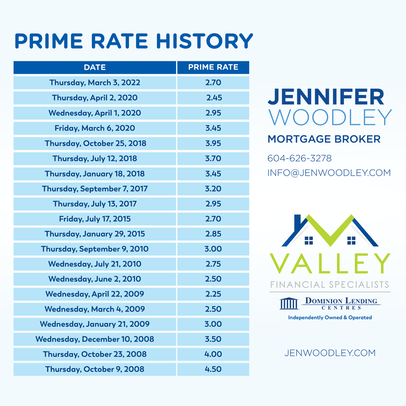

For those of us who work in the mortgage industry, who can see the struggle that borrowers face with these rate increases, our hearts feel immensely heavy right now. Trust me when I tell you that we lose sleep, spend day & night thinking of each and every one of you, and remember every conversation that we have had together over the past couple of years. We hear you and feel you when you say that you are struggling with these rate increases. We lay awake at night and start writing blog posts, like this one, at 3 am. We know that these high rates really suck for all borrowers (there’s really no other way to put it) and that this is not easy. Although it doesn’t alleviate the crushing weight, we try to remember that we gave the best information that we felt we could give at that moment, so that our clients could make informed decisions. This information was based on what we knew at that time, based on historical data, based on what has been best for Canadian borrowers for the past few decades, and based on knowledge from exploring historical trends over the past 80 years. We remember believing in the data so much that we, too, took adjustable and variable rate mortgages for our homes. If you ask any Mortgage Broker in the industry, you will find that the vast majority have variable or adjustable rate mortgages of their own. We remember helping you choose your types of mortgages based on your financial goals, your future outlook, which lender you could qualify with (remember how crazy the market was, and how badly you wanted that home?), how quickly you needed that turnaround (remember the short subject-removal dates, the quick sales needed, and the non-subject offers?), the amount of debt that needed consolidating (remember the yearning to increase cash flow and consolidate consumer debt while rates were low?), and the type of flexibility desired (remember the huge, heartbreaking penalties we saw from fixed rate mortgage clients?). We hope you remember, as well. We remember all these things…but it still hurts to see you hurt, and we so desperately wish that we could do something to take the pain and struggle away. ---- But maybe, just maybe, the way that we can help you breathe a little easier is to help you remember, too… -Do you remember the pandemic panic in 2020 (how can we forget?), when the world turned upside down, everything felt so uncertain, and, in response to this, the Bank of Canada spent most of 2020 and 2021 assuring us all that rate increases were off the table until well into 2023? (In his press conference on October 2020, a reporter asked the Governor of the Bank of Canada, Tiff Macklem, if they were purposely encouraging Canadians to borrow to buy assets, to which he responded: “What we’re saying is that we are going to get through this but it’s going to be a long slog. We’re telling Canadians, and our forward guidance has been very clear, that we are going to hold our policy interest rate at the effective lower bound until slack is absorbed so that we can sustainably achieve our 2% inflation target, and we’ve indicated that’s not going to happen until some time into 2023. What does that mean? Yes, that means if you are a household considering making a big purchase, if you’re a business considering investing, you can be confident that interest rates will be low for a long time.”) …And do you remember when, in 2022, the Bank of Canada changed their mind and started raising rates? -Do you remember last year and the year before, when we thought that the sky-rocketing, out-of-control real estate market would never stop? When potential home buyers were frantically throwing non-subject offers into a hat, feeling hopeless that their offer would actually be considered? …And do you remember how that all turned around and became a buyers’ market within just a few weeks in 2022? -Do you remember the first time that we saw 5-year fixed rates of 1.99% in November of 2012, and every expert said that we would never, ever see them again in our lifetime? …And do you remember the next time we saw them in June of 2020? …And do you remember thinking in 2021 and 2022 that the 1.99% mortgage rate was a high rate, compared to the lower rate that someone else was getting? (I do. I remember losing sleep about a client who had chosen to take a 5-year fixed rate of 1.99%, thinking that if they had not done so, they could have benefited from the low sub-2% variable rate mortgages. I remember clients who were very upset that they locked into fixed rates of 2-3%, who could not break them without huge penalties, while everyone else had the luxury of paying under 2% for their variable rates.) -Do you remember that there was an average of a 2% difference between variable and fixed rates throughout 2021 and the beginning of 2022? (This was one of the main reasons why over 50% of Canadians took variable rate mortgages over the past 1-2 years.) …And do you remember in the past few weeks when lenders started to raise their variable rates and decrease their fixed rates, so that the difference between the two is now less than 0.50%? -Do you remember the last recession, where fixed rates and prime rates rose to 6-7% in 2007-2008? …And do you remember that they steadily declined for the next decade? -Do you remember that Prime Rate started to rise in 2010, and many thought it would continue it’s rise? …And do you remember that Prime Rate didn’t rise above 3% for nearly 8 years after that? (I do. I locked into a restrictive 5-year fixed rate mortgage at 4.79% in 2010 and, in the years following, all fixed rates dropped, and most variable rates remained under or around 2% for the whole term, and beyond.) -Do you remember when inflation rose to 5.63% in 1991? …And do you remember when it fell to 1.49% in 1992, and then further down to 0.17% in 1994? - Do you remember the 80s (I sure don’t…I was just a child. But for those of you who do…) and how, in August of 1981, Prime Rate peaked at 22.75%? …And do you remember how in April of 1983, it had dropped by more than half (11.75%)? …And do you remember that it rose again? And then it fell again. And then it rose again. And then it fell again. These are just examples of a few moments in time, but the point is this: Every difficult moment feels like it will never end. And then it does. The mortgage market, the economy, and life are unpredictable. Economists and experts can try their hardest to predict what will happen next, but no one knows the future. If the past few years of chaos have taught us anything, it’s that nothing is certain. There are ups and there are downs. Just when you think that something will never stop, it does, and it turns right around. And, so, the rate outlook has changed once more… A couple weeks ago, many economists thought the Bank of Canada may raise their overnight rate by 0.75% to 1.0%. Today, they raised it by 0.50%. The Bank of Canada again used hawkish language to say they expect rates to rise further to try to decrease demand in the economy and bring down inflation. The prospect of interest rate decreases suddenly seem slightly further from our reach now, so we are left with the tasks of hanging tight, buckling down our expenses, stopping frivolous spending, implementing ways to increase our income, and tightening our budgets wherever we can. I know it will not be easy, but I believe that you can make it through this. You can do it. I believe you can, because you are strong and resourceful. I believe you can because you have endured and overcome tough times before. I believe you can because we "stress tested" you when you qualified for your mortgage, using these rates this high, and using less than 44% of your household income. And we must try to remember that nothing lasts forever. We remember, and we hope. I truly wish I had all the answers for all of you, but I would be lying if I said that I do. I cannot predict how high rates will get and for how long, if you should choose variable or fixed, if you should lock in now, or whether, if you do lock in, if you will regret the decision in a few years or relish in it. What I can do is to continue to arm you with what we know now, to hopefully help you make a decision for your future. My family and I will be continuing to ride the adjustable and variable wave, despite how gnarly it is, because I have faith that this too shall pass. I know that you have to do whatever you feel is best for your family, too. If you are unsure about what to do, I encourage you to please reach out to me or to your Mortgage Broker to discuss your options. Again, we don't have all the answers, but I am always happy to help where I can. Sending love, light, and hope to all of you through these tough times. <3

0 Comments

If you're feeling exhausted from an incredibly emotional & rough couple of years, a summer of trying really hard to relax despite that nagging feeling of anxiety in the background, and a hectic week of back-to-school and back-to-reality, you're not alone. Although it was expected and really was no surprise, this morning's announcement by the Bank of Canada that they were increasing their key interest rate by 0.75% felt like a "let's-crawl-back-into-bed" kind of moment. I've been sitting here at my desk trying to muster up the energy to write a blog post to address the rate hike and, let me tell you, it's not easy. First off, let me say that I am sending out big hugs to all of you, as you try to muster up the energy to move along too. I feel the weight that you are all carrying, and I know that it is getting heavy. This morning's 0.75% rate increase by the Bank of Canada was not a small one, but hopefully it will be the last "jumbo-sized" increase for a while. In their statement, the Central Bank cited the "effects of COVID-19 outbreaks, ongoing supply disruptions, and the war in Ukraine" as contributing to the ongoing high inflation numbers. At this point, the Bank of Canada has a very delicate task of running after an economy that has gotten away from them, balancing and bringing down inflation, while not completely tumbling the entire economy and causing a deep recession. In short, the Bank of Canada is not done in their quest to bring down inflation. It appears that they are trying to shock the system by scaring or forcing people into limiting their spending, therefore bringing down excess demand and, ultimately, inflation. This is especially important with the holiday season approaching. The good news is that it does appear to be slightly working, as the latest numbers show a glimmer of relief. As summer ends and people get back to "normal", I think and hope that we will see people become more cautious with their finances and will start to tighten the reins. Gas prices have already decreased, and many supply chain/port issues appear to be getting resolved, slowly but surely. Since data is delayed, hopefully the numbers from August and the months to come will be favourable, and we will see the gradual reduction to inflation that the Central Bank is looking for. However, it is important to take note of the last paragraph of the Bank of Canada's statement today, not to scare you but to provide insight into what may come for the future. They wrote: "Given the outlook for inflation, the Governing Council still judges that the policy interest rate will need to rise further. Quantitative tightening is complementing increases in the policy rate. As the effects of tighter monetary policy work through the economy, we will be assessing how much higher interest rates need to go to return inflation to target. The Governing Council remains resolute in its commitment to price stability and will continue to take action as required to achieve the 2% inflation target." In her communication today, Dominion Lending Centre's Chief Economist, Dr. Sherry Cooper, stated her beliefs that the Bank of Canada will continue their tightening until they are highly confident that they have done enough, and will not be quick to reduce their key interest rate so that they do not make the same mistakes that were made in the 80s. She predicted that the Bank of Canada will keep their key interest rate high until later in 2023 or 2024. For people with balances on lines of credit, adjustable rate mortgages, or any other borrowing that is tied to Prime Rate, I know that this is not easy. After all, the Bank of Canada assured us in 2020 that they were going to keep rates unusually low for a very long time, and reemphasized throughout 2021 that rate hikes were off the table for at least the next year or longer. It is hard to see the light at the end of the tunnel, but hopefully you can find hope for the future when looking at key interest rate trends over the last 80 years. You might find this article to be helpful, exploring the last 30 years and the average 13 month hiking cycle: https://financialpost.com/investing/interest-rates-are-still-rising-but-investors-should-start-preparing-for-when-they-come-back-down?fbclid=IwAR2KjmxCopg3AMOpsfDU35M1IW1E074UCq5y3qM0ZWqkIw23rjMGEhteUbI If you are wondering what this rate increase means to your payments for your adjustable rate mortgage or non-static payment variable rate mortgage, here are the numbers: $35-45 increase per month per every $100,000 in mortgage balance (based on a 25 year amortization, depending on your actual adjustable/variable mortgage rate after your discount). $180-$220 increase per month per every $500,000 in mortgage balance (based on a 25 year amortization, depending on your actual adjustable/variable mortgage rate after your discount). For those of you with variable rate mortgages with static payments, you may want to look at increasing your payments similarly. Many of you may be getting close to hitting your trigger rates, so it is important to have all the facts so that you can make sound financial decisions based on your individual situations. Here is some additional information about trigger rates and trigger points: https://www.jenwoodley.com/blog/variable-rate-mortgage-holders-its-time-to-be-proactive-and-start-paying-a-bit-more I know that many of you were able to take advantage of the ultra-low mortgage interest rates over the last few years by making extra prepayments to rapidly pay down your mortgage balance, or by putting your payment savings aside to pad your rainy-day accounts. If you were able and lucky enough to do this, try to remember that your proactive steps have set you up to go easy on yourself in these months of higher interest rates. If you need to take a break from your accelerated payments to soften the cash flow blow, know that this is not giving up but giving yourself a break. If you need some additional ideas of how you might be able to alleviate some cash flow, here are some other options: https://www.jenwoodley.com/blog/ideas-to-minimize-or-manage-higher-mortgage-payments Still Stressed? Remember, for those of you who obtained your mortgages within the last 4-6 years, you already had to pass the Stress Test to get your mortgage. In 2016, for insured mortgages with less than 20% down, and beginning in 2018 for all mortgages, the Canadian Government implemented the mandatory "Stress Test" to ensure that you would be able to withstand these possible interest rate increases. What this means is that even though interest rates at the time that you got your mortgage were lower, you had to qualify for your mortgage based on a hypothetical interest rate of between 4.79% to 5.25%, or in some cases even higher (your contract rate plus 2%). Put it simply, the stress test meant that your monthly housing costs, including your mortgage principal and interest payments (based on the stress test rate), condo/strata fees, heating costs, and potential rental vacancies, could not exceed more than 40% of your gross annual income. In theory, this should leave 60% of your gross annual income to service other living expenses, although we certainly know that taxes account for a significant part of the average household income and that the cost of living has gone up significantly. Hopefully knowing that, at this point, you're still using around or below 40% of your gross income to pay for your housing costs will help you feel less...stressed. (I know...easier said than done) If you're unsure about how to carry on, and are grappling with whether to lock in to a fixed rate or to stay in your adjustable rate/variable rate, please reach out to me or to your Mortgage Broker to discuss. Remember, one of the best features of your current adjustable/variable rate mortgage is that you can break your mortgage with a relatively low penalty (just three months of interest). If you are confident that you would like to lock into a fixed rate at this time, there may be better options outside of your current lender. These better options may be through better rates, better mortgage flexibility, and/or better prepayment penalties if you ever need to break or pay out your current mortgage. I will reiterate that not all fixed rate mortgages are built the same, and it is extremely important that you review the terms of your mortgage before you lock into a fixed rate. We cannot predict the future, but hopefully if we hang in there, have patience, manage our spending, budget properly, make lifestyle changes, and find new income-producing avenues, we can come out of this unscathed and stronger than ever. Now is the time to slow your spending, slow the economy, slow the demand, and buckle down. Me, I'm going to be spending time at home with my family this Fall, catching up on movies, and making lots of homemade soups. Delicious, healthy, budget-friendly, and most importantly for this time, comforting. Questions? Please do not hesitate to reach out. I'm here for you, always. https://www.bankofcanada.ca/2022/09/fad-press-release-2022-09-07/?utm_source=twitter&utm_medium=social&utm_campaign=FAD220907 If you currently have a variable rate mortgage with RBC, CIBC, TD, BMO, HSBC, or most credit unions, you likely have a static-payment variable rate mortgage. This means that even though Prime Rate has risen over the past few months, your payment has remained the same. Since your payment has not changed but the interest rate has, more of your payment has been going towards paying interest rather than paying down your balance. You may have already logged on to your online mortgage/banking account and noticed that your estimated remaining amortization period has been extended.

As Prime Rate has now risen quite a bit this year, I would recommend that you try to be proactive and take advantage of your mortgage prepayment privileges to make extra payments to your mortgage, if you are able to. With most variable rate mortgages, you may prepay up to 10%-15% of your original mortgage balance per year without penalty, and you may also increase your payment by 15%-100% at any time, which can help you to bring the remaining amortization back down. If you are unsure of your prepayment options, it is best to speak with your Lender or your Mortgage Broker to determine what they are. Some lenders may only allow lump sum payments to be made once per year, on your mortgage anniversary date, while some will allow you to make multiple lump sum payments at any time throughout the year. To make lump sum payments or to increase your payment, you can log on to your online banking account or call the lender directly. You may also visit any branch to make these requests. A reminder that the strategy with a variable rate mortgage is a long game, meaning that even though interest rates are higher at the moment, the hope is that they will later fall during the term of your mortgage. If you have had your variable rate mortgage for some time, you have likely benefited from low interest rates for the past 2+ years. The idea is that the overall amount of interest that you pay for the entire term of your mortgage will even/average out, or put you ahead. Historically, variable rate holders have always won the rate game with this strategy. Unfortunately, it appears that the Bank of Canada is doing a bit of catch-up to try to calm and reduce inflation, and most analysts are anticipating that there may be more rate increases this year. With the US Federal Reserve raising its benchmark rate by another 0.75% yesterday, many experts expect that Canada will follow suit. However, most also generally agree that this is likely going to level out within a year or two, so I am hopeful for that. As gas prices start to decrease back to "normal", staffing issues get resolved after summer to help resolve global supply chain issues, and as inflation starts to head back down, I do believe that things will start to get better. I still have faith that history tends to repeat itself and, if you look back over the last 30+ years, the rates have always come back down. In case it is helpful, here is an interesting read about Bank of Canada rate trends over the past 30 years: https://financialpost.com/investing/interest-rates-are-still-rising-but-investors-should-start-preparing-for-when-they-come-back-down?fbclid=IwAR25yXL3AdGHAUHKgYY3JrF7e_lgkQ73U_aRTO-SwInf1p5iFUfjvq0_hjo Also, if you would like to hear more of my thoughts on the latest rate increase, please have a read through my latest blog post: https://www.jenwoodley.com/blog/from-calm-seas-to-rough-waves As Prime Rate rises, you may be wondering what will happen with your mortgage if you choose to maintain your original payment. Some lenders, such as the credit unions, reserve the right to adjust periodic payment amounts to account for changes in the interest rate. They may reach out to you soon to speak with you about your best options at this time. You could also choose to contact them proactively to discuss. Other lenders may wait until you hit your "trigger rate", at which point they may require that you take action. Others may defer your interest (add it to your mortgage balance), until later. Here is some information about how one Big Bank, TD Canada Trust, treats their Trigger Rate and Trigger Point: What is the difference between Trigger Rate and Trigger Point? Trigger Rate:

Trigger Point:

What happens once a Customer reaches the Trigger Point? How are they notified?

In case you would like to play around with some numbers on your own, I have an easy and free phone app that can help you estimate your payments. Here is a link to download the app: https://dlcapp.ca/app/jennifer-woodley. If you would like to see what your payments should be at this time to maintain your original amortization schedule, please use your original mortgage balance (as stated on your original mortgage documents), your original amortization, and your lender's current Prime Rate minus your original "discount". For example, Prime Rate with most lenders is currently 4.70%, as of today, July 28th, 2022, and your discount may be "minus 0.80%". Therefore, the actual interest rate for your mortgage is now 3.90% (ie. 4.70% minus 0.80%). Please note that if you have a "regular" variable rate mortgage with TD (not a TD Flexline mortgage), your current Prime Rate may be 4.85%, as of today. Some time ago, TD decided to pave their own path and create their own Mortgage Prime Rate (not the same as the Prime Rate that they use for HELOCs or other products). Lastly, if you are worried about rates continuing to rise and are considering locking into a fixed rate, please feel free to reach out to me to discuss this further. One thing that some variable and adjustable rate mortgage holders are doing to offset this fear is to increase payments to match what your payments would be if you were to lock in to a fixed rate at this time. You can determine this payment by using the "simple mortgage calculator" in the phone app noted above. Currently, fixed rates are sitting around 5.24% to 5.44% for 3-5 year term fixed rate mortgages with most lenders. If you increase your payment to this amount, this will help to pay down your mortgage balance without reducing your mortgage flexibility and possibly having to incur a large penalty if you need to break your mortgage in the future. I hope this information has been helpful. Please do not hesitate to reach out if you have any questions or if there is anything that I can assist you with. Remember that this will not last forever. I am here for you, whenever you need me! Have a wonderful long weekend! Close your eyes. Take a deep breath. Imagine you are on a long boat ride across the sea. There are calm waters and there are big waves but, in the end, when you step off that boat, you still walk away on the same level that you left on...the ground. For those of us who have been in variable and adjustable rate mortgages for many years, our boat ride has felt more like a leisurely sail down a calm sea with the warm, gentle wind blowing through our hair. Alas, today the Bank of Canada raised their key interest rate by a full 1.00%, their largest move in 24 years. The waves have now come to take us to the peak of our interest rate journey and the rough seas are making many people want to jump ship. Before you panic and jump overboard, try to remember that the seas will one day get calm again and that, inevitably, our feet will once again touch ground. With inflation on a rampage worldwide, excess demand, tight labour markets, and supply chain issues wreaking havoc globally, it is no surprise to most people that the Bank of Canada increased their key interest rate significantly today. However, many economists had been predicting an increase of 0.75% to follow the US Federal Reserve move, and then perhaps an additional increase later in the year. It seems as if the Bank of Canada has decided to get ahead of the curve with their 1% increase to try to get a hold of an economy that has gotten away from them. So what does it all mean? Hopefully it is short term pain (higher mortgage interest rates) for long term gain (lower demand and lower inflation). Will it work? That's yet to be determined. Will there be additional rate hikes after this? It's possible. Will it last forever? NO. Don't forget that in March of 2020, the Bank of Canada also cut their interest rate by 1.50% over the course of just one month. Over the past year, they have now increased it by 2.25%. For those of us who have had mortgages well before 2020, that is an actual increase of 0.75% compared to higher pre-pandemic rates. Below, I present to you the 80 year history of the Bank of Canada key interest rate. Calms seas and rough waves. Over, and over again. One thing that you can see for certain is that nothing is ever constant. After each significant spike in interest rates, there is a period of interest rates on the decline. The long game of the variable and adjustable rate mortgage continues on. Yesterday, a 5 year adjustable rate mortgage balance of $500,000 with a rate of Prime Rate minus 0.70% and a 30 year amortization had a payment of $2,103.01 per month.

Today (or whenever your lender makes the change to Prime Rate), the same mortgage will now have a payment of $2,377.59 per month. That is a difference of $274.58. I know that hurts. ...Especially with the cost of everything else rising. But I know you can do it. For those of us with adjustable rate mortgages (non-static variable rate mortgages), you may feel the pain sooner than others, as your mortgage payments will increase. However, don't forget that when rates go down, your payments will also follow suit and decrease. And just remember that if you've had that same mortgage for a few years now (as in the above example, Prime minus 0.70%), you were paying 1.75% for nearly two years from 2020 to 2022. In fact, most/many of you with even larger adjustable rate/variable rate mortgage discounts of Prime minus 1.0% to 1.30% were paying much less. Hopefully many of you have already been heeding my advice to put your interest savings of the past into a savings account for this very moment. We knew that a higher interest rate environment was bound to come, although perhaps we never knew to this extent. For those of you with static-payment variable rate mortgages, you may have noticed that your amortization has been increasing, as less of your mortgage payment is now going towards paying down your mortgage balance and more has been going towards paying interest. Now is not the time to panic. Now is not the time for regrets. Now is the time to remain calm, trust in your decision, and get through this turbulent period together. Now is the time for those of you with variable rate mortgages to start increasing your payments, if you can, to help you continue to pay off your mortgage balance. You can do this by logging into your mortgage account online or calling your lender to request an increase to your payments. Alternatively, you should also be able to put down lump sum prepayments using your prepayment privileges, if that is easier. Now is the time for those of you who have been putting away your interest savings in anticipation for this moment to dip into those savings, if you need to. Now is the time to go through your finances and make the cuts you've been meaning to make for a long time now. If you can get out of that gym membership that you haven't been using, do it. If you only watch one show on that one streaming service, cut it. If you still have cable, call up your company and renegotiate your rate (or better yet, cut that too...I cancelled cable a couple years ago and I haven't looked back). Better yet, call every service provider that you can and renegotiate everything. Now is the time to stop spending on things you don't need. Now is the time to evaluate your options to manage these higher interest rates and payments. Here are a few suggestions on how to manage higher mortgage payments. Now is the time to keep in mind that the Government has been "stress-testing" all mortgages since 2018 to ensure that all borrowers can withstand an increase of at least 2% to their mortgage interest rates. If you got a mortgage after this time, the Lenders and the Government made sure you would be able to financially sustain this increase using approximately 40% of your pre-tax income. Now is the time to remember also the flexibility that the variable/adjustable rate mortgage offers you! If and when interest rates start to come down, us variable/adjustable rate mortgage holders can jump at the opportunity to lock into a low fixed rate mortgage without penalty, if that is what you so choose. You can also choose to break your mortgage with just 3 months of interest penalty to switch lenders and shop around for an even better mortgage, whether that be an adjustable rate mortgage, a variable rate mortgage, or a fixed rate mortgage with a different lender. The future may be unpredictable but the possibilities are endless. I know it is uncomfortable and unenjoyable to have to pay more than you had to before, but it's important to remember that it won't be forever. Again, it's a long game. If you chose a variable or adjustable rate mortgage, I hope that you remember why you made this choice. No matter what you do in the coming months/years, it's important to have all the information at hand to make an informed decision. Adjustable and variable rate mortgages are not for everyone, but if you are going to lock into a fixed rate mortgage, please talk to a Mortgage Broker first. Not all fixed rate mortgages are built the same. Some lower fixed rate mortgages can equate to much higher penalties and costs later on. So close your eyes. Take a deep breath. Imagine the beautiful calm seas. If you look far enough out onto the horizon, you will see the beautiful warm sun coming again. I'm riding this wave with all of you and happy to answer any questions that you may have. Hang tight, everyone. Paying more for your mortgage?

I know it's not easy after enjoying such low interest rates for such a long time, but there may be some ways to manage it. If you're in an Adjustable Rate Mortgage (also sometimes called a Variable Rate Mortgage with a non-static payment), you have likely noticed that your payments have started to rise with the Bank of Canada rate increases/increases to Prime Rate. First, before you panic about rates rising and whether you will be able to make your payments, try to remember that, for the past 2-4 years, all mortgage borrowers have had to qualify for their mortgages based on the mandatory Government "stress test". This means that, despite some of the record low interest rates that we have actually been paying over the past few years, borrowers have been forced to show that they will be able to make the payments if rates were to rise as high as 4.89-5.25%, using approximately 40-44% of their income to pay for mortgage and non-mortgage debt. If you got a mortgage in the last 4 years, then you passed this test. Granted, I know this calculation does not include a number of factors such as daycare costs (for some of you), gas prices, and the overall increase to the cost of living lately, but hopefully it's a tiny bit comforting to know that *on paper* you should hypothetically be able to make the payments based on 40% of your pretax income, leaving 60% of your income for those other expenses and taxes. If that's not comforting (I tried!), here are a few ideas to help you minimize/manage your mortgage payments:

Just one more note: if you're in a Variable Rate Mortgage (with a static payment), your payment may not have risen automatically. However, if paying off your mortgage is your goal, you may want to think about increasing your payment (if you are able to), since more of your mortgage payment is now going towards interest instead of paying your principal balance. Questions? Please feel free to reach out! I am happy to help. Hang in there! We won't be in this space, or in this place, forever. Many of you have been receiving your property tax bills over the past few days, and most property taxes will be due on July 4th - 5th this year.

IMPORTANT: If you are eligible, please do not forget to apply for your Home Owner Grant! This must be done EVERY YEAR, and it is your responsibility to claim the grant. Banks DO NOT do this on your behalf. If you pay your taxes through your Lender/with your mortgage, please make sure to forward a copy of the tax bill to your Lender/your servicing branch if it does not indicate "COPY SENT TO MORTGAGE LENDER" in the upper header section of the tax notice. This will assist in preventing any late tax payment penalties. If this is your FIRST YEAR with your Lender, it would be a good idea to contact them at your earliest convenience to check on the payment status of your property taxes this year, and to let them know that you have applied for your Home Owner Grant. Depending on when your new mortgage closed, you may be expected to make this year's property tax payment directly to your municipality, even if your lender collects regular property tax payments from you. For example, if your new mortgage closed after March 1st, 2022, some Lenders may not have had enough time to get you onto the full payment cycle for this year, and the payments that they have been collecting are actually for next year (2023). The easiest and fastest way to pay your property taxes is with online banking or setting up a pre-authorized payment plan with City Hall directly. Please check your property tax bill or visit your municipality's website for more information. Please do not hesitate to ask if you have any questions. Have a great day! As widely expected and projected by many industry analysts for the past month and a half, the Bank of Canada raised their key interest rate by another 0.50% this morning. To many who have been following the news, this comes as no shock; however, even those who were expecting it are still feeling somewhat perturbed by this rate hike. After all, the rising cost of, well...everything is now hitting our mortgages and household debt.

Before you panic, it's important at this time to keep a level head and to put everything into perspective. How WILL this ACTUALLY affect your mortgage? ~ For those of you with Fixed Rate mortgages, today's Bank of Canada rate increase will not affect you at all. Your rate and payment will stay the same. ~ For those of you with Variable Rate mortgages with static payments, your payments should remain the same. However, the amount of your mortgage payment that goes towards interest will increase, while the amount of your payment that goes towards paying down your principal amount of your mortgage balance will decrease. If you would like to stick with your original amortization schedule (ie. the original plan on how long it will take you to pay off your mortgage), I would recommend that you contact your Lender to ask them to increase your payment accordingly. Please see below. ~ For those of you with Adjustable Rate mortgages (sometimes called Variable Rate mortgages with Non-Static payments), your payment will change based on the 0.50% increase to Prime Rate. The change in your payment will likely come next month on your next month's payment date, or may come sooner for some Lenders, depending on your payment frequency. Your Lender will likely send you a notice to let you know what your payment change will look like. - To put it simply, your mortgage payment will likely rise approximately $26 for every $100,000 of your mortgage balance (based on a 25 year amortization). On a $500,000 mortgage balance, that will be an increase of around $130 per month. - If you've been applying my suggest strategy for the last few months/years and have been putting aside the monthly savings that you would have paid if you had chosen a fixed rate, you likely will have a sizable slush fund to pay for this increase. - If this amount sounds like a lot to swallow, it is important to REMEMBER how much money you have been saving over the past few months and years! The strategy with variable/adjustable rate mortgages is a LONG GAME. Interest rates may rise and fall over the course of your mortgage term and, historically, the variable rate mortgage holders have always won the Rate Game. It's important to note that, despite the increase to Prime Rate today, Variable/Adjustable Rate mortgage rates are still much lower than those of Fixed Rates mortgages today. They also offer much more flexibility (ie. smaller penalties) than Fixed Rate mortgages. As such, I do not believe that now is the time to panic and it is certainly not the time to lock into a 5-year Fixed Rate mortgage product at 4.5-5%. If, as many people believe, we are heading into a recession and rates begin to drop again, those of you with Variable/Adjustable Rate mortgages will have the opportunity to break your mortgages and secure a lower rate. Remember, we knew that the ultra-low rate environment would not last forever. - We also know that an ultra-high rate environment will not last forever, either. If you're unsure about what type of mortgage you have and how today's rate increase will affect you, reach out to your Mortgage Broker or Lender! Any further questions? I'm happy to help! Please do not hesitate to reach out. ---> And, yes....I still have two variable/adjustable rate mortgages of my own and, NO, I will not be locking into a fixed rate at this time! Keep calm, and ride the wave with me... In her keynote speech last week, Deputy Governor of the Bank of Canada, Sharon Kozicki, asserted that the Bank of Canada is "prepared to act forcefully" to bring inflation back down to 2% by using their monetary policy tools. However, she also confirmed that the Bank is cautious about tightening their monetary policy too quickly which could further promote inequality and hardships for some households. "While we will watch developments with respect to households closely as we proceed, it's important to be clear: Returning inflation to the 2% target is our primary focus and our unwavering commitment. We have taken action and will continue to do so to return inflation to target, and we're prepared to act forcefully" - Deputy Governor - Bank of Canada, Sharon Kozicki, March 25, 2022: https://youtu.be/IlKh0yAJMOg In light of Ms. Kozicki's speech, many economists are now predicting that the Bank of Canada will announce a 0.50% increase to their key policy rate in their April 13th announcement. So...is now a good time to panic? Should you lock into a Fixed Rate Mortgage? Fear of the unknown is a large driver in the mortgage market, and there is a reason why 3/4 of mortgages in Canada are Fixed Rate Mortgages. People find comfort in predictability...and so do the Banks. But... Isn't it important to consider that the 1/4 of Canadians with Variable Rate Mortgages have been the big winners and paid less overall interest for over a decade? Inevitably, rates will rise. The "emergency" low rates of the pandemic cannot last forever. We cannot predict the future. However, what we CAN do is explore the past and learn FOR our future. Let's look at some quick and easy numbers: Let's say you have a $500,000 balance with a 25 year amortization and a 5-year closed Variable Rate Mortgage at Prime Rate minus 0.80% right now. That 0.80% is called your "discount", and you will have your discount for your entire 5-year Variable Rate term. With Prime Rate currently at 2.70%, this means that your current interest rate is 1.90% (2.70% - 0.80% = 1.90%), and your monthly payment is $2,095.01. (In fact, your rate may even be lower...some of you may have been lucky enough to secure Variable Rate discounts over 1.0% recently!) In contrast, current 5-year Fixed Rate Mortgages with many of the Big Banks have now risen to approximately 3.89% to 4.14%! With a $500,000 balance and a rate of 3.89%, these fixed rate payments would be $2,600.37. Therefore, there is now an interest rate difference of nearly 2% between Fixed and Variable Rate Mortgages, and this amounts to a savings of $505.36 per month for Variable Rate Mortgage holders. But...What if Prime Rate rises? If the Bank of Canada acts "forcefully", as they say, and raises their key interest rate by a half percent in April (raising Prime Rate to 3.20%), this will drive your Variable Rate interest rate to 2.40%. $500,000 at 2.40% = $2,217.99/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $382.38 per month. Let's say that the Bank of Canada acts even more aggressively and raises rates to "pre-pandemic" levels. After all, Prime Rate in October 2018 went as high as 3.95%, and stayed that way until April 2020, when it dropped to 3.45% at the beginning of the pandemic. In this scenario, even if the Bank of Canada raised their key interest rate and Prime Rate rose to 3.95%, your rate would still only be 3.15% (3.95% - 0.80%). $500,000 at 3.15% = $2,410.25/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $190.12 per month. Let's go back even further in time to our last recession from October 2008 to May 2009. Granted, the world has changed a lot since then, especially the real estate market! During this time period, Prime Rate rose to 4.50%. In this scenario, even if Prime Rate rose to this past-recession rate of 4.50%, your rate would be 3.70% (4.50% - 0.80%) ...again, still lower than current 5-year Fixed Rates right now. $500,000 at 3.70% = $2,557.07/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $43.30 per month. Don't forget...what goes up must come down! If you look at historical Prime Rate changes over the last 14 years in the chart below, you will see that Prime Rate has fluctuated from as high as 4.50% to as low as 2.25%. With a Variable Rate Mortgage, remember that rates may rise and fall multiple times during the term of your mortgage. While rates may be high for a period of time during your mortgage term, you may actually pay less interest overall due to the period(s) of time where you saved interest (when Prime Rate was low). As I have mentioned in previous posts, you can always mitigate the risk of rising rates by taking advantage of the savings NOW.

I would recommend that you put aside the $505.36/month into a savings account or use it to pay down your principal balance faster. This way, if/when rates rise, you will be ready. (And, remember, if you have a STATIC Variable Rate Mortgage, your payments may not change at all.) Still don't have the stomach to ride the Variable-Rate-Mortgage-wave? That's okay! The type of mortgage that you choose is entirely your decision and depends on your comfort level. A Variable Rate Mortgage is not for everyone. If you feel more comfortable with a Fixed Rate Mortgage, then you should go for it. However, before you do, it's important to consider a few things: >> Flexibility - Not all Fixed Rate Mortgages are built the same. Some Fixed Rate Mortgage penalties offer more forgiving penalty calculations if you ever need to get out of your Fixed Rate Mortgage contract. In general, many of the Big Banks and some Credit Unions include the "original discount" that you receive from their posted rates in their Fixed Rate Mortgage penalty calculations (called the IRD, or Interest Rate Differential), while others do not. Including the "original discount" into the IRD penalty calculation can increase the cost of the penalty. If you are set on staying with a lender who includes the "original discount" in their IRD calculations, you may be better off considering the 3 and 4 year Fixed Rate options because the difference between the 3 and 4 year contract vs posted rates tend to be smaller than those of the 5-year Fixed Rates. In contrast, the penalty to break a Variable Rate Mortgage is just 3 months of interest. >> Qualification - Did you know that you now qualify for a larger mortgage if you take a Variable Rate Mortgage? The current government-mandated stress test stipulates that we must use "the higher of the contract rate + 2%, or the 5-year benchmark rate" for qualification. For Fixed Rate Mortgages, the rate used for qualification would be approximately 5.89% (3.89% contract rate plus 2%). For Variable Rate Mortgages that are still under 3.25%, the lenders can still use the qualifying rate at 5.25%. >> Rate - Different classifications of mortgages have led to an array of interest rate offerings across the mortgage market. If your remaining amortization is below 25 years, if the original purchase price of your home was under $1,000,000, if you purchased your home with less than 20% down, and/or if you have a lot of equity in your home, there may be better rate options out there for you. Final Thoughts: So, is it time to lock into a Fixed Rate Mortgage, or should you continue to ride the wave? There is no crystal ball. Ultimately, the decision lies with you and your comfort level after arming yourself with the knowledge above. Will rates rise? Yes, rates will rise someday. Perhaps someday soon. Will rates fall? Yes, rates will fall someday. I believe that the Bank of Canada will likely raise their key interest rate aggressively and quickly this year to try to curb inflation. However, I do not foresee them maintaining high interest rates for a long period of time and believe that we will see rates start to fall again next year. With current real estate prices, high amounts of indebtedness across the country, pandemic recovery, and many other global factors, I do not believe that a high-interest rate environment will be sustainable for our economy. We're likely in for a bit of a ride but, with the right knowledge, tools, and a little bit of courage, I am confident that you can and will make a sound mortgage decision. Please do not hesitate to ask if you have any questions! I'm happy to help! Attention Variable Rate Mortgage Holders:

Do Not Panic. The Bank of Canada raised its key interest rate by 0.25% today - just as they have been telling us that they would. Citing uncertainty due to the unprovoked invasion of Ukraine, high inflation, and a stronger than expected first-quarter growth, the Central Bank did just as we expected. The biggest question is..."SHOULD I LOCK IN?" Remember: It is just a 0.25% increase. We knew this was going to happen at some time or another! It was part of your mortgage strategy. Please consider the following: The monthly payments on a $500,000 mortgage with a 25 year amortization and a Variable Rate at 1.50% was previously $1,999.68 per month. A 0.25% increase in rate to 1.75% increases your payments to $2,058.95, which is a difference of only $59.27 per month. If you have a static payment variable rate, your payment won't change at all. If you were to lock yourself into a 5-year Fixed Rate at 3.29%, an average 5-year fixed rate in the industry right now, your monthly mortgage payment would be $2,441.25. That is a difference of $382.30 per month, or $4,587.60 per year! In addition to this $382.30 extra per month, you would be changing the flexibility of your mortgage. If you ever need to break a Variable Rate Mortgage, the penalty is just 3 months of interest (around 0.5% of your mortgage). In contrast, penalties for breaking Fixed Rate Mortgages are determined using the "Interest Rate Differential", a calculation that can be up to 4.5% of your mortgage balance! The Bank of Canada would have to raise their Key Interest Rate SIX times before you arrived at where Fixed Rates are right now, as they usually move their rates in increments of 0.25%. It's important to keep in mind that the Bank of Canada makes just 8 rate announcements per year. Prime Rates with the lenders will likely rise from 2.45% to 2.70% today. The highest Prime Rate has been in the last 12 years is 3.95%...only 1.25% higher than today. I've done the calculations, and even if the Bank of Canada increases their rate by 0.50% per year for the next 5 years, you will still come out thousands of dollars ahead with a variable rate mortgage right now. Remember, the Banks LOVE Fixed Rate Mortgages, and would love to see you locking into those fixed rates right now. The Economists that you often see quoted in the news are paid by the Banks. These same Economists have been predicting a rate increase of 1.50% or higher for over 10 years...and they have been WRONG. Historically, Variable Rate Mortgage holders have always "won" the rate game. So...Don't panic! Keep calm, stick with your strategy, and remember that the sky is not falling. NOW is the time to be taking advantage of this ultra-low rate environment! Put aside that $382.30 per month into a savings account, if you are concerned about rates rising in the future, or Use your prepayment privileges that came with your mortgage to make extra payments to pay down your mortgage balance quicker. Be PROACTIVE! And CONGRATULATIONS on all of the money you have been saving!! As Public Enemy once told us, "Don't believe the hype...don't, don't, don't believe the hype".

By now, you have likely heard that mortgage interest rates are on the move. Bond yields are at a two-year high, and inflation continues to sky-rocket to levels not seen in decades. Scary stuff, right? It only seems fitting that interest rates will start to rise too. I have been receiving many calls and messages from Variable Rate Mortgage holders asking if they should lock into a Fixed Rate. With the Bank of Canada set to make their first key interest rate announcement of 2022 next Wednesday (Jan 26th), Economists have widely speculated that Canada's Central Bank could start raising their key interest rate right out of the gates. But what does that really mean for borrowers, especially for you Variable Rate Mortgage holders who have been lucky enough to have these ultra-low interest rates for quite some time? Here's the thing. The Banks LOVE Fixed Rate Mortgages, and the Economists that you often see quoted in the news are paid by the Banks. These same Economists have been predicting a rate increase of 1.50% or higher for over 10 years...and they have been WRONG. Historically, Variable Rate Mortgage holders have always "won" the rate game. Here are the facts: - Variable Rates remain LOW. The average Variable Rate Mortgage is currently around 1.35-1.70%. - Fixed Rates are rising. While I have been typing this post, I received a message from one of the Big 6 Banks, telling me that they are raising their 5-year Fixed Rate to 3.29%, effective tomorrow. - Variable Rate Mortgages are tied to the Lender's Prime Rate, which is influenced by the Bank of Canada's Overnight/Key Interest rate. When the Bank of Canada increases or decreases their key interest rate, the Banks usually increase or decrease their Prime Rates accordingly. - Historically, the Bank of Canada *usually* increases their Key Interest rate in increments of 0.25% (in rare cases, by 0.50%). Consider the following scenario: A $500,000 mortgage with a 25 year amortization and a Variable Rate mortgage at 1.50% = current Monthly Payment of $1,999.68. - If the Bank of Canada increases their Key Interest Rate by 0.25% next week, this would raise the Variable Rate to 1.75%, increasing payments to $2,058.95. That's a difference of only $59.27 per month. - If you were to lock yourself into a 5-year Fixed Rate at 3.29%, your monthly mortgage payment will be $2,441.25. That is a difference of $441.57 per month! - In addition to this $441.57 extra per month, you would be changing the flexibility of your mortgage. If you ever need to break a Variable Rate Mortgage, the penalty is just 3 months of interest (around 0.5% of your mortgage). In contrast, penalties for breaking Fixed Rate Mortgages are determined using the "Interest Rate Differential", a calculation that can be up to 4.5% of your mortgage balance! The Bank of Canada would have to raise their Key Interest Rate SEVEN times before you arrived at where Fixed Rates are right now. It's important to keep in mind that the Bank of Canada makes just 8 rate announcements per year. So...is it possible? Maybe. But, given the state of our economy after enduring this wicked pandemic, I feel the likelihood of this happening very quickly is very slim. So, don't panic! NOW is the time to be taking advantage of this ultra-low rate environment! Make extra payments to your mortgage, if you can. Put aside that $441.57 per month into a savings account, if you are concerned about rates rising in the future. Be PRO-ACTIVE! And CONGRATULATIONS on all of the money you have been saving!! One last thought: Again, Public Enemy said it best: "False media - We don't need it do we? [...]...Don't believe the hype." This article recently came out, among other sensationalized headlines: "Bank Of Canada Will Raise Rates 500% This Year, To Start Within Weeks: National Bank" https://betterdwelling.com/bank-of-canada-will-raise.../ Guys, with the Bank of Canada's Key Interest Rate currently at 0.25%, a "500% increase" is just 1.25%. Be smart with your money. Be aware. And don't believe the hype. |

Jennifer WoodleyMortgage Broker Archives

October 2022

Categories |

Jennifer Woodley | Dominion Lending Centres Valley Financial Specialists | 604.626.3278 | [email protected]

RSS Feed

RSS Feed