|

If you currently have a variable rate mortgage with RBC, CIBC, TD, BMO, HSBC, or most credit unions, you likely have a static-payment variable rate mortgage. This means that even though Prime Rate has risen over the past few months, your payment has remained the same. Since your payment has not changed but the interest rate has, more of your payment has been going towards paying interest rather than paying down your balance. You may have already logged on to your online mortgage/banking account and noticed that your estimated remaining amortization period has been extended.

As Prime Rate has now risen quite a bit this year, I would recommend that you try to be proactive and take advantage of your mortgage prepayment privileges to make extra payments to your mortgage, if you are able to. With most variable rate mortgages, you may prepay up to 10%-15% of your original mortgage balance per year without penalty, and you may also increase your payment by 15%-100% at any time, which can help you to bring the remaining amortization back down. If you are unsure of your prepayment options, it is best to speak with your Lender or your Mortgage Broker to determine what they are. Some lenders may only allow lump sum payments to be made once per year, on your mortgage anniversary date, while some will allow you to make multiple lump sum payments at any time throughout the year. To make lump sum payments or to increase your payment, you can log on to your online banking account or call the lender directly. You may also visit any branch to make these requests. A reminder that the strategy with a variable rate mortgage is a long game, meaning that even though interest rates are higher at the moment, the hope is that they will later fall during the term of your mortgage. If you have had your variable rate mortgage for some time, you have likely benefited from low interest rates for the past 2+ years. The idea is that the overall amount of interest that you pay for the entire term of your mortgage will even/average out, or put you ahead. Historically, variable rate holders have always won the rate game with this strategy. Unfortunately, it appears that the Bank of Canada is doing a bit of catch-up to try to calm and reduce inflation, and most analysts are anticipating that there may be more rate increases this year. With the US Federal Reserve raising its benchmark rate by another 0.75% yesterday, many experts expect that Canada will follow suit. However, most also generally agree that this is likely going to level out within a year or two, so I am hopeful for that. As gas prices start to decrease back to "normal", staffing issues get resolved after summer to help resolve global supply chain issues, and as inflation starts to head back down, I do believe that things will start to get better. I still have faith that history tends to repeat itself and, if you look back over the last 30+ years, the rates have always come back down. In case it is helpful, here is an interesting read about Bank of Canada rate trends over the past 30 years: https://financialpost.com/investing/interest-rates-are-still-rising-but-investors-should-start-preparing-for-when-they-come-back-down?fbclid=IwAR25yXL3AdGHAUHKgYY3JrF7e_lgkQ73U_aRTO-SwInf1p5iFUfjvq0_hjo Also, if you would like to hear more of my thoughts on the latest rate increase, please have a read through my latest blog post: https://www.jenwoodley.com/blog/from-calm-seas-to-rough-waves As Prime Rate rises, you may be wondering what will happen with your mortgage if you choose to maintain your original payment. Some lenders, such as the credit unions, reserve the right to adjust periodic payment amounts to account for changes in the interest rate. They may reach out to you soon to speak with you about your best options at this time. You could also choose to contact them proactively to discuss. Other lenders may wait until you hit your "trigger rate", at which point they may require that you take action. Others may defer your interest (add it to your mortgage balance), until later. Here is some information about how one Big Bank, TD Canada Trust, treats their Trigger Rate and Trigger Point: What is the difference between Trigger Rate and Trigger Point? Trigger Rate:

Trigger Point:

What happens once a Customer reaches the Trigger Point? How are they notified?

In case you would like to play around with some numbers on your own, I have an easy and free phone app that can help you estimate your payments. Here is a link to download the app: https://dlcapp.ca/app/jennifer-woodley. If you would like to see what your payments should be at this time to maintain your original amortization schedule, please use your original mortgage balance (as stated on your original mortgage documents), your original amortization, and your lender's current Prime Rate minus your original "discount". For example, Prime Rate with most lenders is currently 4.70%, as of today, July 28th, 2022, and your discount may be "minus 0.80%". Therefore, the actual interest rate for your mortgage is now 3.90% (ie. 4.70% minus 0.80%). Please note that if you have a "regular" variable rate mortgage with TD (not a TD Flexline mortgage), your current Prime Rate may be 4.85%, as of today. Some time ago, TD decided to pave their own path and create their own Mortgage Prime Rate (not the same as the Prime Rate that they use for HELOCs or other products). Lastly, if you are worried about rates continuing to rise and are considering locking into a fixed rate, please feel free to reach out to me to discuss this further. One thing that some variable and adjustable rate mortgage holders are doing to offset this fear is to increase payments to match what your payments would be if you were to lock in to a fixed rate at this time. You can determine this payment by using the "simple mortgage calculator" in the phone app noted above. Currently, fixed rates are sitting around 5.24% to 5.44% for 3-5 year term fixed rate mortgages with most lenders. If you increase your payment to this amount, this will help to pay down your mortgage balance without reducing your mortgage flexibility and possibly having to incur a large penalty if you need to break your mortgage in the future. I hope this information has been helpful. Please do not hesitate to reach out if you have any questions or if there is anything that I can assist you with. Remember that this will not last forever. I am here for you, whenever you need me! Have a wonderful long weekend!

3 Comments

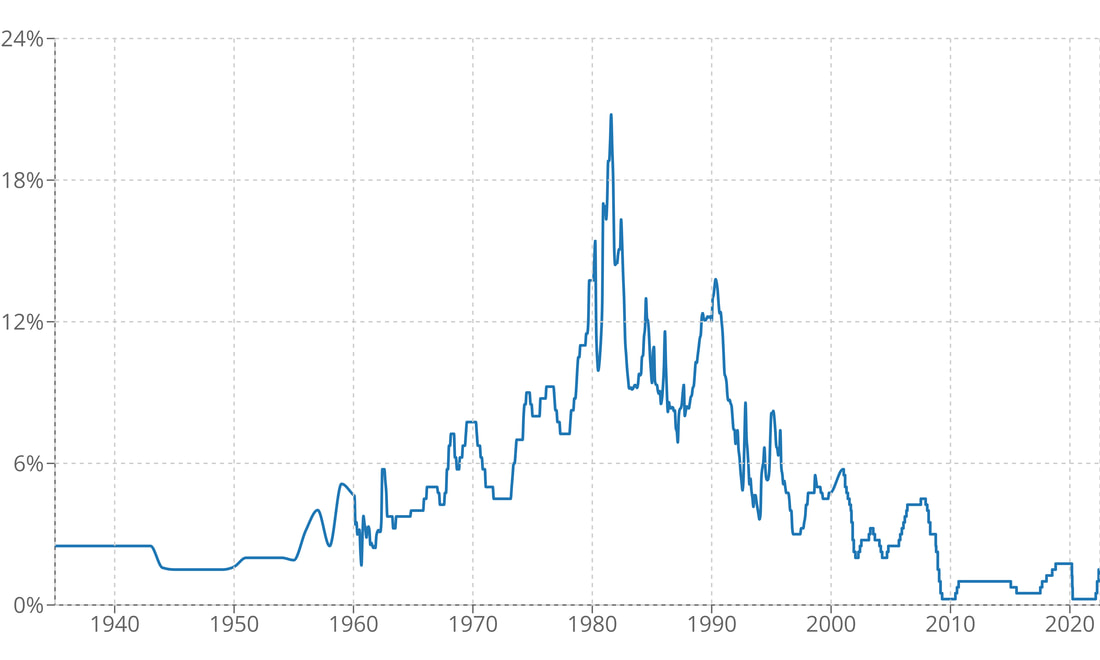

Close your eyes. Take a deep breath. Imagine you are on a long boat ride across the sea. There are calm waters and there are big waves but, in the end, when you step off that boat, you still walk away on the same level that you left on...the ground. For those of us who have been in variable and adjustable rate mortgages for many years, our boat ride has felt more like a leisurely sail down a calm sea with the warm, gentle wind blowing through our hair. Alas, today the Bank of Canada raised their key interest rate by a full 1.00%, their largest move in 24 years. The waves have now come to take us to the peak of our interest rate journey and the rough seas are making many people want to jump ship. Before you panic and jump overboard, try to remember that the seas will one day get calm again and that, inevitably, our feet will once again touch ground. With inflation on a rampage worldwide, excess demand, tight labour markets, and supply chain issues wreaking havoc globally, it is no surprise to most people that the Bank of Canada increased their key interest rate significantly today. However, many economists had been predicting an increase of 0.75% to follow the US Federal Reserve move, and then perhaps an additional increase later in the year. It seems as if the Bank of Canada has decided to get ahead of the curve with their 1% increase to try to get a hold of an economy that has gotten away from them. So what does it all mean? Hopefully it is short term pain (higher mortgage interest rates) for long term gain (lower demand and lower inflation). Will it work? That's yet to be determined. Will there be additional rate hikes after this? It's possible. Will it last forever? NO. Don't forget that in March of 2020, the Bank of Canada also cut their interest rate by 1.50% over the course of just one month. Over the past year, they have now increased it by 2.25%. For those of us who have had mortgages well before 2020, that is an actual increase of 0.75% compared to higher pre-pandemic rates. Below, I present to you the 80 year history of the Bank of Canada key interest rate. Calms seas and rough waves. Over, and over again. One thing that you can see for certain is that nothing is ever constant. After each significant spike in interest rates, there is a period of interest rates on the decline. The long game of the variable and adjustable rate mortgage continues on. Yesterday, a 5 year adjustable rate mortgage balance of $500,000 with a rate of Prime Rate minus 0.70% and a 30 year amortization had a payment of $2,103.01 per month.

Today (or whenever your lender makes the change to Prime Rate), the same mortgage will now have a payment of $2,377.59 per month. That is a difference of $274.58. I know that hurts. ...Especially with the cost of everything else rising. But I know you can do it. For those of us with adjustable rate mortgages (non-static variable rate mortgages), you may feel the pain sooner than others, as your mortgage payments will increase. However, don't forget that when rates go down, your payments will also follow suit and decrease. And just remember that if you've had that same mortgage for a few years now (as in the above example, Prime minus 0.70%), you were paying 1.75% for nearly two years from 2020 to 2022. In fact, most/many of you with even larger adjustable rate/variable rate mortgage discounts of Prime minus 1.0% to 1.30% were paying much less. Hopefully many of you have already been heeding my advice to put your interest savings of the past into a savings account for this very moment. We knew that a higher interest rate environment was bound to come, although perhaps we never knew to this extent. For those of you with static-payment variable rate mortgages, you may have noticed that your amortization has been increasing, as less of your mortgage payment is now going towards paying down your mortgage balance and more has been going towards paying interest. Now is not the time to panic. Now is not the time for regrets. Now is the time to remain calm, trust in your decision, and get through this turbulent period together. Now is the time for those of you with variable rate mortgages to start increasing your payments, if you can, to help you continue to pay off your mortgage balance. You can do this by logging into your mortgage account online or calling your lender to request an increase to your payments. Alternatively, you should also be able to put down lump sum prepayments using your prepayment privileges, if that is easier. Now is the time for those of you who have been putting away your interest savings in anticipation for this moment to dip into those savings, if you need to. Now is the time to go through your finances and make the cuts you've been meaning to make for a long time now. If you can get out of that gym membership that you haven't been using, do it. If you only watch one show on that one streaming service, cut it. If you still have cable, call up your company and renegotiate your rate (or better yet, cut that too...I cancelled cable a couple years ago and I haven't looked back). Better yet, call every service provider that you can and renegotiate everything. Now is the time to stop spending on things you don't need. Now is the time to evaluate your options to manage these higher interest rates and payments. Here are a few suggestions on how to manage higher mortgage payments. Now is the time to keep in mind that the Government has been "stress-testing" all mortgages since 2018 to ensure that all borrowers can withstand an increase of at least 2% to their mortgage interest rates. If you got a mortgage after this time, the Lenders and the Government made sure you would be able to financially sustain this increase using approximately 40% of your pre-tax income. Now is the time to remember also the flexibility that the variable/adjustable rate mortgage offers you! If and when interest rates start to come down, us variable/adjustable rate mortgage holders can jump at the opportunity to lock into a low fixed rate mortgage without penalty, if that is what you so choose. You can also choose to break your mortgage with just 3 months of interest penalty to switch lenders and shop around for an even better mortgage, whether that be an adjustable rate mortgage, a variable rate mortgage, or a fixed rate mortgage with a different lender. The future may be unpredictable but the possibilities are endless. I know it is uncomfortable and unenjoyable to have to pay more than you had to before, but it's important to remember that it won't be forever. Again, it's a long game. If you chose a variable or adjustable rate mortgage, I hope that you remember why you made this choice. No matter what you do in the coming months/years, it's important to have all the information at hand to make an informed decision. Adjustable and variable rate mortgages are not for everyone, but if you are going to lock into a fixed rate mortgage, please talk to a Mortgage Broker first. Not all fixed rate mortgages are built the same. Some lower fixed rate mortgages can equate to much higher penalties and costs later on. So close your eyes. Take a deep breath. Imagine the beautiful calm seas. If you look far enough out onto the horizon, you will see the beautiful warm sun coming again. I'm riding this wave with all of you and happy to answer any questions that you may have. Hang tight, everyone. |

Jennifer WoodleyMortgage Broker Archives

October 2022

Categories |

Jennifer Woodley | Dominion Lending Centres Valley Financial Specialists | 604.626.3278 | [email protected]

RSS Feed

RSS Feed