|

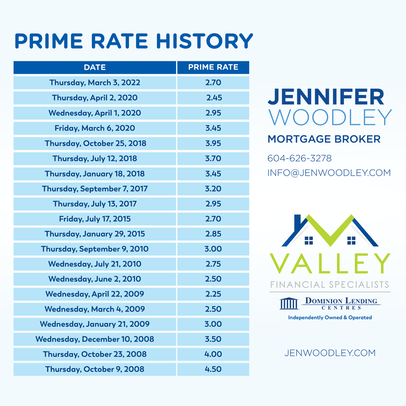

In her keynote speech last week, Deputy Governor of the Bank of Canada, Sharon Kozicki, asserted that the Bank of Canada is "prepared to act forcefully" to bring inflation back down to 2% by using their monetary policy tools. However, she also confirmed that the Bank is cautious about tightening their monetary policy too quickly which could further promote inequality and hardships for some households. "While we will watch developments with respect to households closely as we proceed, it's important to be clear: Returning inflation to the 2% target is our primary focus and our unwavering commitment. We have taken action and will continue to do so to return inflation to target, and we're prepared to act forcefully" - Deputy Governor - Bank of Canada, Sharon Kozicki, March 25, 2022: https://youtu.be/IlKh0yAJMOg In light of Ms. Kozicki's speech, many economists are now predicting that the Bank of Canada will announce a 0.50% increase to their key policy rate in their April 13th announcement. So...is now a good time to panic? Should you lock into a Fixed Rate Mortgage? Fear of the unknown is a large driver in the mortgage market, and there is a reason why 3/4 of mortgages in Canada are Fixed Rate Mortgages. People find comfort in predictability...and so do the Banks. But... Isn't it important to consider that the 1/4 of Canadians with Variable Rate Mortgages have been the big winners and paid less overall interest for over a decade? Inevitably, rates will rise. The "emergency" low rates of the pandemic cannot last forever. We cannot predict the future. However, what we CAN do is explore the past and learn FOR our future. Let's look at some quick and easy numbers: Let's say you have a $500,000 balance with a 25 year amortization and a 5-year closed Variable Rate Mortgage at Prime Rate minus 0.80% right now. That 0.80% is called your "discount", and you will have your discount for your entire 5-year Variable Rate term. With Prime Rate currently at 2.70%, this means that your current interest rate is 1.90% (2.70% - 0.80% = 1.90%), and your monthly payment is $2,095.01. (In fact, your rate may even be lower...some of you may have been lucky enough to secure Variable Rate discounts over 1.0% recently!) In contrast, current 5-year Fixed Rate Mortgages with many of the Big Banks have now risen to approximately 3.89% to 4.14%! With a $500,000 balance and a rate of 3.89%, these fixed rate payments would be $2,600.37. Therefore, there is now an interest rate difference of nearly 2% between Fixed and Variable Rate Mortgages, and this amounts to a savings of $505.36 per month for Variable Rate Mortgage holders. But...What if Prime Rate rises? If the Bank of Canada acts "forcefully", as they say, and raises their key interest rate by a half percent in April (raising Prime Rate to 3.20%), this will drive your Variable Rate interest rate to 2.40%. $500,000 at 2.40% = $2,217.99/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $382.38 per month. Let's say that the Bank of Canada acts even more aggressively and raises rates to "pre-pandemic" levels. After all, Prime Rate in October 2018 went as high as 3.95%, and stayed that way until April 2020, when it dropped to 3.45% at the beginning of the pandemic. In this scenario, even if the Bank of Canada raised their key interest rate and Prime Rate rose to 3.95%, your rate would still only be 3.15% (3.95% - 0.80%). $500,000 at 3.15% = $2,410.25/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $190.12 per month. Let's go back even further in time to our last recession from October 2008 to May 2009. Granted, the world has changed a lot since then, especially the real estate market! During this time period, Prime Rate rose to 4.50%. In this scenario, even if Prime Rate rose to this past-recession rate of 4.50%, your rate would be 3.70% (4.50% - 0.80%) ...again, still lower than current 5-year Fixed Rates right now. $500,000 at 3.70% = $2,557.07/month $500,000 at 3.89% = $2,600.37/month With a Variable Rate Mortgage, you would still be saving $43.30 per month. Don't forget...what goes up must come down! If you look at historical Prime Rate changes over the last 14 years in the chart below, you will see that Prime Rate has fluctuated from as high as 4.50% to as low as 2.25%. With a Variable Rate Mortgage, remember that rates may rise and fall multiple times during the term of your mortgage. While rates may be high for a period of time during your mortgage term, you may actually pay less interest overall due to the period(s) of time where you saved interest (when Prime Rate was low). As I have mentioned in previous posts, you can always mitigate the risk of rising rates by taking advantage of the savings NOW.

I would recommend that you put aside the $505.36/month into a savings account or use it to pay down your principal balance faster. This way, if/when rates rise, you will be ready. (And, remember, if you have a STATIC Variable Rate Mortgage, your payments may not change at all.) Still don't have the stomach to ride the Variable-Rate-Mortgage-wave? That's okay! The type of mortgage that you choose is entirely your decision and depends on your comfort level. A Variable Rate Mortgage is not for everyone. If you feel more comfortable with a Fixed Rate Mortgage, then you should go for it. However, before you do, it's important to consider a few things: >> Flexibility - Not all Fixed Rate Mortgages are built the same. Some Fixed Rate Mortgage penalties offer more forgiving penalty calculations if you ever need to get out of your Fixed Rate Mortgage contract. In general, many of the Big Banks and some Credit Unions include the "original discount" that you receive from their posted rates in their Fixed Rate Mortgage penalty calculations (called the IRD, or Interest Rate Differential), while others do not. Including the "original discount" into the IRD penalty calculation can increase the cost of the penalty. If you are set on staying with a lender who includes the "original discount" in their IRD calculations, you may be better off considering the 3 and 4 year Fixed Rate options because the difference between the 3 and 4 year contract vs posted rates tend to be smaller than those of the 5-year Fixed Rates. In contrast, the penalty to break a Variable Rate Mortgage is just 3 months of interest. >> Qualification - Did you know that you now qualify for a larger mortgage if you take a Variable Rate Mortgage? The current government-mandated stress test stipulates that we must use "the higher of the contract rate + 2%, or the 5-year benchmark rate" for qualification. For Fixed Rate Mortgages, the rate used for qualification would be approximately 5.89% (3.89% contract rate plus 2%). For Variable Rate Mortgages that are still under 3.25%, the lenders can still use the qualifying rate at 5.25%. >> Rate - Different classifications of mortgages have led to an array of interest rate offerings across the mortgage market. If your remaining amortization is below 25 years, if the original purchase price of your home was under $1,000,000, if you purchased your home with less than 20% down, and/or if you have a lot of equity in your home, there may be better rate options out there for you. Final Thoughts: So, is it time to lock into a Fixed Rate Mortgage, or should you continue to ride the wave? There is no crystal ball. Ultimately, the decision lies with you and your comfort level after arming yourself with the knowledge above. Will rates rise? Yes, rates will rise someday. Perhaps someday soon. Will rates fall? Yes, rates will fall someday. I believe that the Bank of Canada will likely raise their key interest rate aggressively and quickly this year to try to curb inflation. However, I do not foresee them maintaining high interest rates for a long period of time and believe that we will see rates start to fall again next year. With current real estate prices, high amounts of indebtedness across the country, pandemic recovery, and many other global factors, I do not believe that a high-interest rate environment will be sustainable for our economy. We're likely in for a bit of a ride but, with the right knowledge, tools, and a little bit of courage, I am confident that you can and will make a sound mortgage decision. Please do not hesitate to ask if you have any questions! I'm happy to help!

1 Comment

Attention Variable Rate Mortgage Holders:

Do Not Panic. The Bank of Canada raised its key interest rate by 0.25% today - just as they have been telling us that they would. Citing uncertainty due to the unprovoked invasion of Ukraine, high inflation, and a stronger than expected first-quarter growth, the Central Bank did just as we expected. The biggest question is..."SHOULD I LOCK IN?" Remember: It is just a 0.25% increase. We knew this was going to happen at some time or another! It was part of your mortgage strategy. Please consider the following: The monthly payments on a $500,000 mortgage with a 25 year amortization and a Variable Rate at 1.50% was previously $1,999.68 per month. A 0.25% increase in rate to 1.75% increases your payments to $2,058.95, which is a difference of only $59.27 per month. If you have a static payment variable rate, your payment won't change at all. If you were to lock yourself into a 5-year Fixed Rate at 3.29%, an average 5-year fixed rate in the industry right now, your monthly mortgage payment would be $2,441.25. That is a difference of $382.30 per month, or $4,587.60 per year! In addition to this $382.30 extra per month, you would be changing the flexibility of your mortgage. If you ever need to break a Variable Rate Mortgage, the penalty is just 3 months of interest (around 0.5% of your mortgage). In contrast, penalties for breaking Fixed Rate Mortgages are determined using the "Interest Rate Differential", a calculation that can be up to 4.5% of your mortgage balance! The Bank of Canada would have to raise their Key Interest Rate SIX times before you arrived at where Fixed Rates are right now, as they usually move their rates in increments of 0.25%. It's important to keep in mind that the Bank of Canada makes just 8 rate announcements per year. Prime Rates with the lenders will likely rise from 2.45% to 2.70% today. The highest Prime Rate has been in the last 12 years is 3.95%...only 1.25% higher than today. I've done the calculations, and even if the Bank of Canada increases their rate by 0.50% per year for the next 5 years, you will still come out thousands of dollars ahead with a variable rate mortgage right now. Remember, the Banks LOVE Fixed Rate Mortgages, and would love to see you locking into those fixed rates right now. The Economists that you often see quoted in the news are paid by the Banks. These same Economists have been predicting a rate increase of 1.50% or higher for over 10 years...and they have been WRONG. Historically, Variable Rate Mortgage holders have always "won" the rate game. So...Don't panic! Keep calm, stick with your strategy, and remember that the sky is not falling. NOW is the time to be taking advantage of this ultra-low rate environment! Put aside that $382.30 per month into a savings account, if you are concerned about rates rising in the future, or Use your prepayment privileges that came with your mortgage to make extra payments to pay down your mortgage balance quicker. Be PROACTIVE! And CONGRATULATIONS on all of the money you have been saving!! As Public Enemy once told us, "Don't believe the hype...don't, don't, don't believe the hype".

By now, you have likely heard that mortgage interest rates are on the move. Bond yields are at a two-year high, and inflation continues to sky-rocket to levels not seen in decades. Scary stuff, right? It only seems fitting that interest rates will start to rise too. I have been receiving many calls and messages from Variable Rate Mortgage holders asking if they should lock into a Fixed Rate. With the Bank of Canada set to make their first key interest rate announcement of 2022 next Wednesday (Jan 26th), Economists have widely speculated that Canada's Central Bank could start raising their key interest rate right out of the gates. But what does that really mean for borrowers, especially for you Variable Rate Mortgage holders who have been lucky enough to have these ultra-low interest rates for quite some time? Here's the thing. The Banks LOVE Fixed Rate Mortgages, and the Economists that you often see quoted in the news are paid by the Banks. These same Economists have been predicting a rate increase of 1.50% or higher for over 10 years...and they have been WRONG. Historically, Variable Rate Mortgage holders have always "won" the rate game. Here are the facts: - Variable Rates remain LOW. The average Variable Rate Mortgage is currently around 1.35-1.70%. - Fixed Rates are rising. While I have been typing this post, I received a message from one of the Big 6 Banks, telling me that they are raising their 5-year Fixed Rate to 3.29%, effective tomorrow. - Variable Rate Mortgages are tied to the Lender's Prime Rate, which is influenced by the Bank of Canada's Overnight/Key Interest rate. When the Bank of Canada increases or decreases their key interest rate, the Banks usually increase or decrease their Prime Rates accordingly. - Historically, the Bank of Canada *usually* increases their Key Interest rate in increments of 0.25% (in rare cases, by 0.50%). Consider the following scenario: A $500,000 mortgage with a 25 year amortization and a Variable Rate mortgage at 1.50% = current Monthly Payment of $1,999.68. - If the Bank of Canada increases their Key Interest Rate by 0.25% next week, this would raise the Variable Rate to 1.75%, increasing payments to $2,058.95. That's a difference of only $59.27 per month. - If you were to lock yourself into a 5-year Fixed Rate at 3.29%, your monthly mortgage payment will be $2,441.25. That is a difference of $441.57 per month! - In addition to this $441.57 extra per month, you would be changing the flexibility of your mortgage. If you ever need to break a Variable Rate Mortgage, the penalty is just 3 months of interest (around 0.5% of your mortgage). In contrast, penalties for breaking Fixed Rate Mortgages are determined using the "Interest Rate Differential", a calculation that can be up to 4.5% of your mortgage balance! The Bank of Canada would have to raise their Key Interest Rate SEVEN times before you arrived at where Fixed Rates are right now. It's important to keep in mind that the Bank of Canada makes just 8 rate announcements per year. So...is it possible? Maybe. But, given the state of our economy after enduring this wicked pandemic, I feel the likelihood of this happening very quickly is very slim. So, don't panic! NOW is the time to be taking advantage of this ultra-low rate environment! Make extra payments to your mortgage, if you can. Put aside that $441.57 per month into a savings account, if you are concerned about rates rising in the future. Be PRO-ACTIVE! And CONGRATULATIONS on all of the money you have been saving!! One last thought: Again, Public Enemy said it best: "False media - We don't need it do we? [...]...Don't believe the hype." This article recently came out, among other sensationalized headlines: "Bank Of Canada Will Raise Rates 500% This Year, To Start Within Weeks: National Bank" https://betterdwelling.com/bank-of-canada-will-raise.../ Guys, with the Bank of Canada's Key Interest Rate currently at 0.25%, a "500% increase" is just 1.25%. Be smart with your money. Be aware. And don't believe the hype. |

Jennifer WoodleyMortgage Broker Archives

October 2022

Categories |

Jennifer Woodley | Dominion Lending Centres Valley Financial Specialists | 604.626.3278 | [email protected]

RSS Feed

RSS Feed